Costs of amusement diversion social activities ceremonials and related incidental costs such as bar charges tips personal telephone calls and laundry charges of participants or guests are unallowable. But as a general rule dont even try to deduct taxes from your tax bill.

Chapter 5 Non Business Income Students

The following expenses are not allowable for reimbursement.

. Unrealised foreign exchange loss. Fundraising or Lobbying costs see Fundraising Flowchart Fines and penalties. Legal fees are usually allowable and this includes costs of chasing debts.

The following are more common non-allowable expenses. Unallowable Expenses but not limited to Any purchase over Cardholders approved transaction limit Pyramiding Capitalized equipment or betterments to capitalized equipment Cash advances Computersnotebooks laptops tablets and other computing equipment. Depreciation and loss on disposal capital assets.

Type of Expense Allowable Unallowable Mailings information on testing dates Title I activities and services etc X Office equipment printers copiers fax machines etc X Non-promotional pamphlets or brochures for informing parents of assessments school achievement important dates etc X Parent award events banquets etc. Allowable when specifically allocable to the project. Expenses except food Communication phones postage Facilities costs rent utilities Insurance Licenses professional Marketing promotional Must be allocable to HRSA sponsored services not solely organization Printing costs Patient travel Publications subscriptions Software EHREMR.

Lease rentals for passenger cars exceeding rm50000 or rm100000 per car the latter amount being applicable to vehicles costing rm150000 or less which have not been used prior to the rental. Donations unless they contribute via Gift Aid. Customer gifts under 50 and not including products with advertising.

Taxes In some states you may be able to deduct small portions of your federal income taxes from your state taxes. Capital outlay expenditures unless specifically included in the contract contributions depreciation expenses unless specifically included in the contract entertainment expenses fundraising non-sufficient check charges penalties and fines. Adoption expenses see if you might qualify for the Adoption Tax Credit Alimony payments Brokers commissions for IRA or other investment property Burial funeral and cemetery expenses Campaign expenses Capital expenses but you can depreciate business property.

Advertising only certain types are allowable Alcoholic beverages. These truly non-allowable fees include. Non-Exhaustive List of Deductible Expenses A-Z Accounting fee Administrative expenses Advertisement Auditors remuneration Bad debts trade debtors Bank charges Bookkeeping services Commission CPF skills development levy foreign workers levy CPF Statutory contributions to CPF.

Fines and penalties Sorry you wont be able to write these off. Memorabilia or promotional materials. Does not meet the criteria listed in Circular A-122 to be allowable.

Provision of expenses General provision of bad debt Depreciation and loss on disposal capital assets Unrealised foreign exchange loss 2CAPITAL EXPENDITURE. Provision of expenses General provision of bad debt Depreciation and loss on disposal capital assets Unrealised foreign exchange loss 2CAPITAL EXPENDITURE. Certain expenses are specifically disallowed non allowable expenses for example.

Entertainment and Personal Expenses. Expenses that are not incurred. Donations unless they contribute via Gift Aid.

Knowing what expenses are not tax deductible might help company to minimise such expenses. Legal feesoften for share capital or capital items such as equipment or property. 1EXPENSES THAT ARE NOT INCURRED.

Ad Track Your Expenses Easily With QuickBooks - Highly-Rated Tracking Software. Sample Unallowable Costs Alcoholic Beverages Bad Debts Contingency Provisions Contributions and Donations Entertainment Fines and Penalties Fund Raising Costs Gift Cards Interest on Borrowed Capital Lobbying Costs Social Memberships. Donationscontributions FAR 31205-8 Fines and penalties FAR 31205-15 Advertisements and.

Non-Allowable Expenses Guide. 41 rows List of Unallowable Expenditure Types. J25 Insurance costs to protect against defects in the institutions materials or workmanship are unallowable.

The cost of repairs are usually revenue and allowable for corporation tax. Pre-commencement expenses Costs including incidental costs of acquiring improving or altering capital assets. Cost Category Allowable Cost Examples Unallowable Cost Examples Mileage reimbursement for program employees to use their Mileage reimbursement non-grant funded personnel or personally owned vehicles to travel to participate in project- grant-related activities.

DOJ Grants Financial Guide 39 Allowable Costs Compensation for Personal Services. Related meetings and events to transport victims to access. Generally the following expenses are not deductible.

J26 Interest fund raising and investment management costs are unallowable except for cost related to the physical custody and control of monies and. Allowable and not-allowable company expenses for tax purposes 3 Repairs and renewals. The list includes both travel and entertainment expenses TE as well as non-travel expenses.

General provision of bad debt. Save Time Track Money And Get Important Insights With Easy Expense Tracking. Computers used ONLY on the grant-funded project are allowable if identified in proposal or approved by granting agency.

General-purpose equipment office furniture or general use personal computer is normally not allowable. The same rule applies. The following items are not reimbursable nor allowed on a University-owned credit card P-Card or direct billed to the University of Richmond.

Some common examples of unallowable costs under Office of Management and Budget guidelines include but are not limited to. J23 Housing and personal living expenses are unallowable. Pre-commencement expenses Costs including incidental costs of acquiring improving or altering capital assets.

Here are a list of expenses that the IRS generally considers nondeductible. And here is a list of the common non-allowable expenses that businesses try to claim. Customer gifts under 50 and not including products with advertising.

Domestic private or capital expenditure. To avoid tax investigations and so that your team has more simplified approach to expenses here is a list of commonly claimed non-allowable expenses. 1EXPENSES THAT ARE NOT INCURRED.

Attorney fees charged by the lender Real estate broker or agent commissions or fees Fees for appraisals requested by the lender or seller for a Reconsideration of Value Fees for appraisals requested by anyone other than the veteran or seller Fees for a flood zone determination by the lender or appraiser. Cost Category Allowable Cost Examples Unallowable Cost Examples A. Moving costs if employee resigns within 12 months.

Legal and professional fees. However meals may be allowable as provided under Allowable Costs-Meals above. The list is intended as a guide but may not cover all non-allowable.

Award funds may be used to pay the salary for full- and part-time employees who will spend their time and effort providing services to victims of crime.

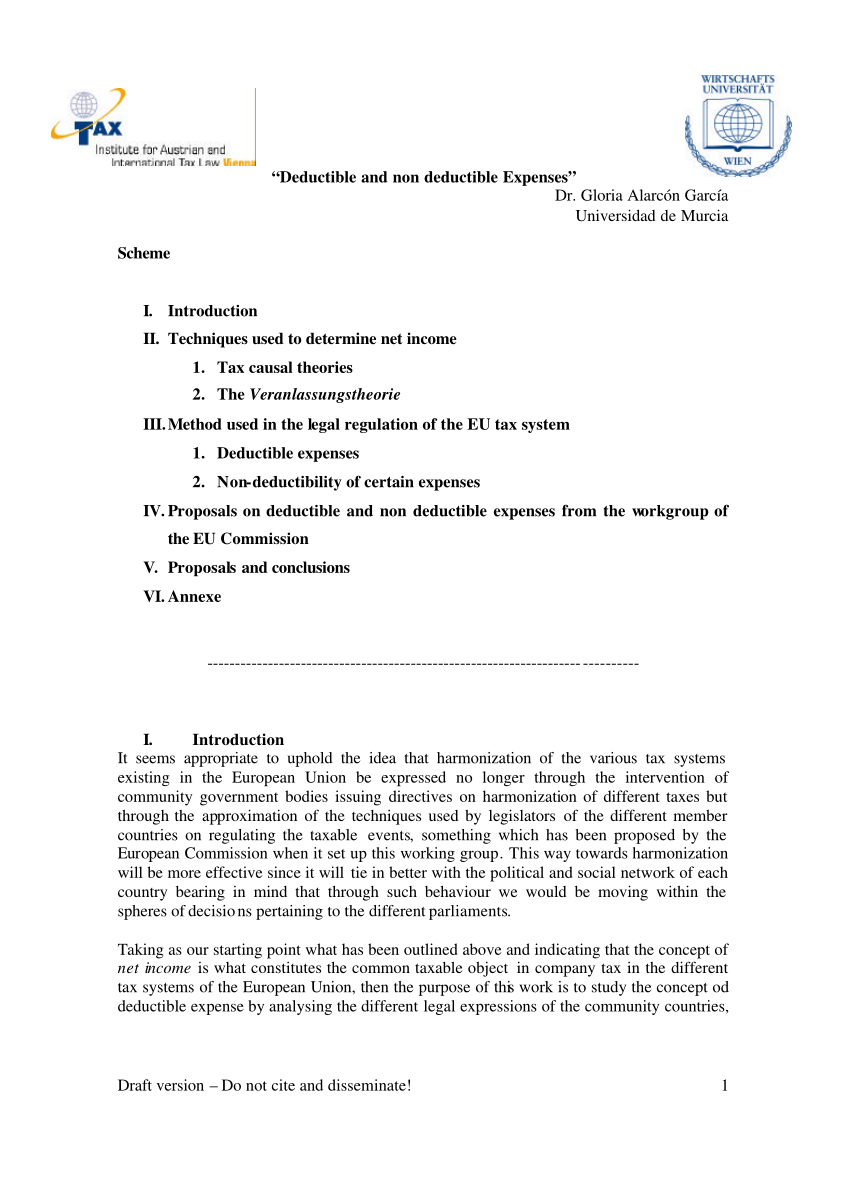

Business Income Format Of Business Income March 2020 July 2020 Computation Of Statutory Studocu

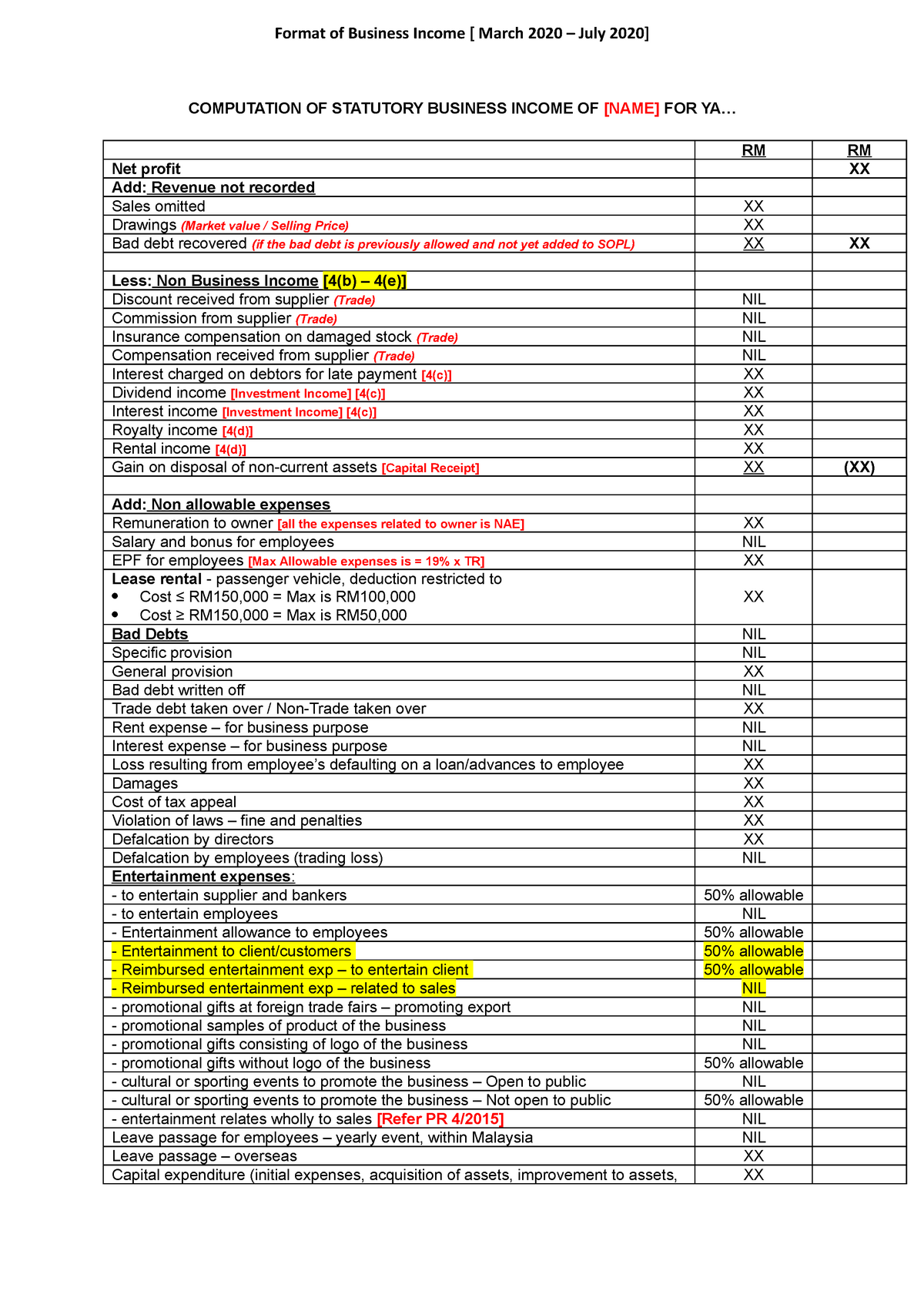

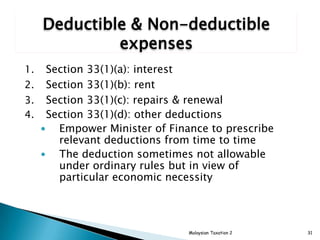

Chapter 5 Corporate Tax Stds 2

Pdf Deductible And Non Deductible Expenses

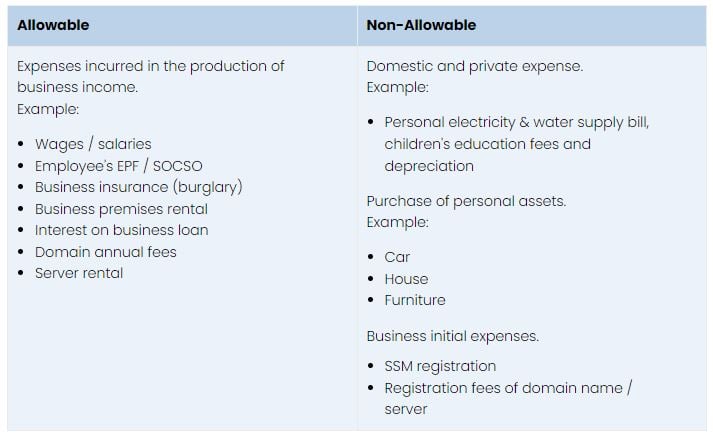

How To File Income Tax For Your Side Business

51 Catchy Dog Grooming Slogans And Good Taglines Dog Grooming Salons Pet Grooming Salon Dog Grooming

What To Include In Your Business Expense Policy Sentrichr

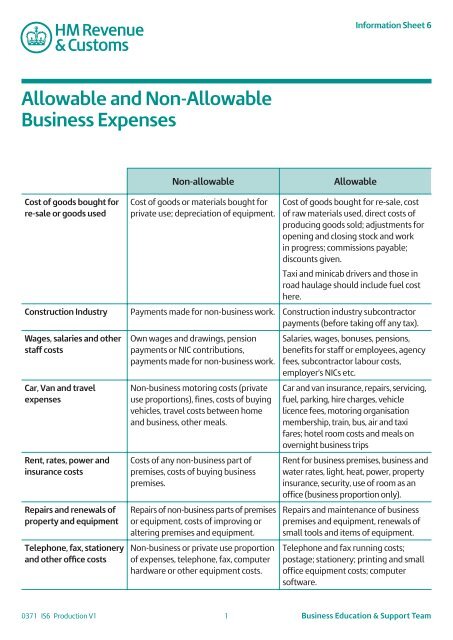

Allowable And Non Allowable Business Expenses

How To Create A 501 C 3 Tax Compliant Donation Receipt Donorbox Donation Letter Donate Fundraising Letter

Chapter 5 Non Business Income Students

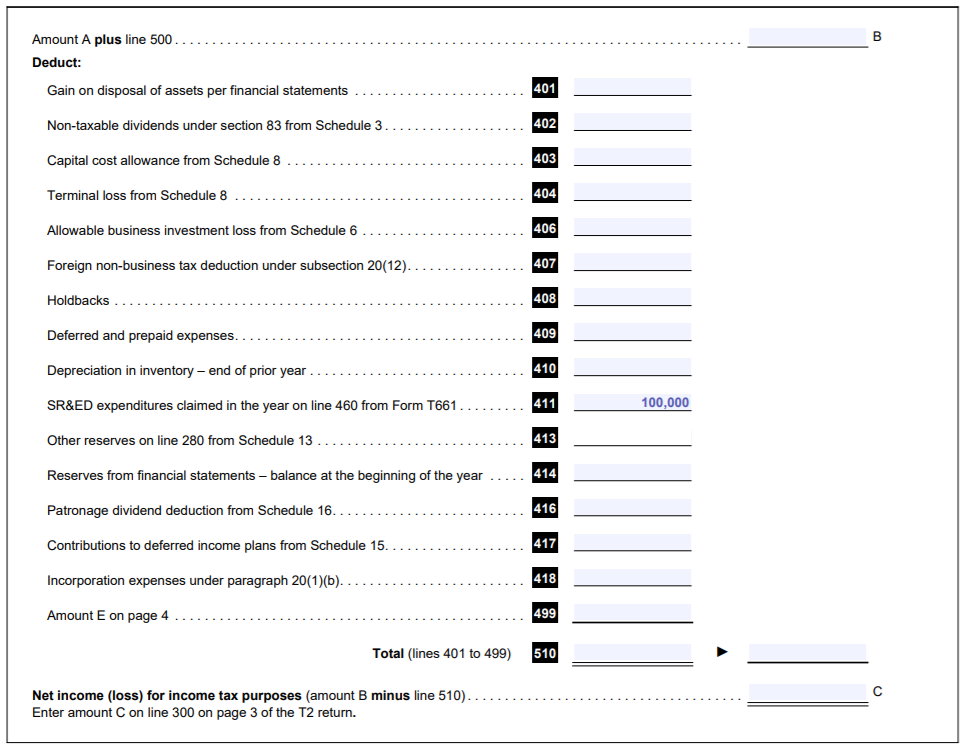

Can You Carry Forward The Pool Of Deductible Sr Ed Expenditures Sr Ed Education And Resources

Five Common Questions To Ask Yourself About Tax Deductible Expenses

Allowable And Non Allowable Business Expenses

List Of Tax Deduction For Businesses Cheng Co Group

Chapter 5 Corporate Tax Stds 2

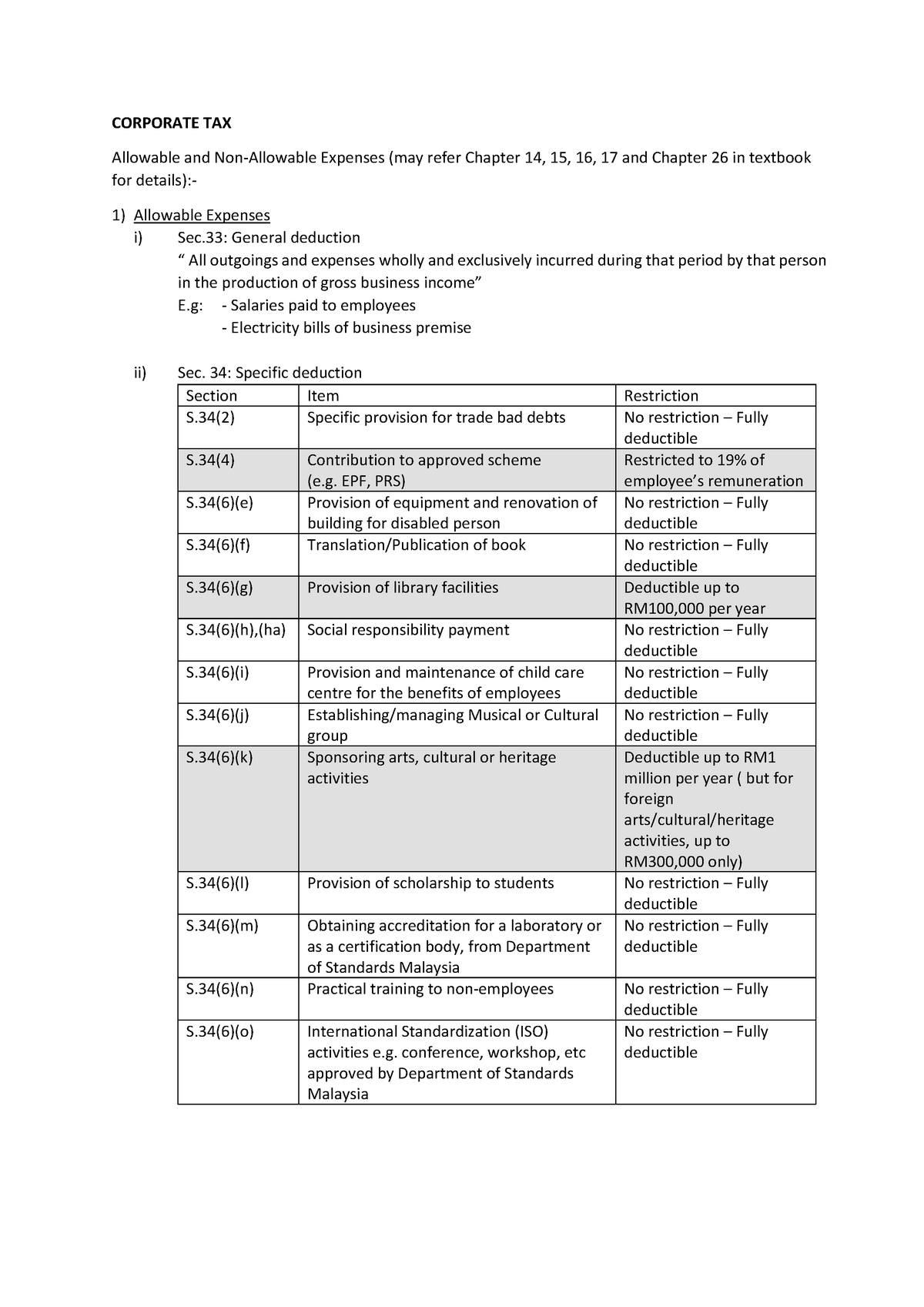

Corporate Tax Note Tax317 Corporate Tax Allowable And Non Allowable Expenses May Refer Chapter Studocu

Allowable And Non Allowable Business Expenses